Home & lifestyle insurance

You are unique, so your home insurance should be, too.

Discover our tailor-made solutions to protect your home every day. Benefit from home insurance tailored to your needs, so you can live with peace of mind.

How does it work?

Choose and combine your home insurance that suits you!

mozaïk is essential cover + useful cover + optional cover,

that you can combine as you wish to create a home insurance policy that matches your life.

Your essential guarantees

- Fire and associated risks

- Terrorist atttacks, labour disputes, vandalism and damage to real estate property

- Storms, hail, weight of snow and ice on roofs

- Water damage and frozen installation

- Breakage of windows, glass and mirrors

Useful coverage from your home insurance in Luxembourg

To ensure you an adequate protection, we have selected for you the essential coverage.

Theft and vandalism

Have you lost your keys or have you been the victim of a break-in, theft or an act of vandalism?

Natural disasters

Has your neighbourhood been hit with a natural disaster and damaged your house ? mozaïk home insurance in Luxembourg covers you in case of flood, earthquake or landslide.

Technological items

Home based electronics, Ultra HD TV, multimedia equipment or your latest robot vacuum, all of these technological equipments are covered in case of accidental breakage or theft.

Portable items

Smartphones, cameras, tablets, consoles and other connected objects are part of our daily lives. With the “Portable items” cover, you are always covered, everywhere.

Eco energies

Your home is equipped with environmentally-friendly systems, such as a heat pump, solar panels, wind power, etc. All these facilities are insured against accidental damage, theft and also against indirect losses due to loss of productivity.

Legal expenses cover

Are you in a dispute with your telephone operator or did your neighbour build a wall without authorisation? Don’t let any dispute complicate your life. The “legal protection” cover assists you in your procedures.

Life third-party liability

Have you accidentally broken a friend’s valuable vase or did your child scratch the neighbour’s car? The third-party liability cover allows you to avoid potentially very high costs. It covers financial damages and personal body injury.

Art and Passion coverage

Do you collect works of art? Are you a connoisseur of fine wines? Foyer protects your assets. Thanks to mozaïk home insurance, all of your exceptional belongings are covered everywhere in the world, including during their transport.

Modules

To ensure your lifestyle, we offer you a mosaic of possibilities with the modules of your home insurance.

Travelling

Book your holidays worry-free. mozaïk takes care of unexpected issues like cancellations, repatriation, medical costs or lost luggage.

We accompany you around the world starting from the first night of your trip.

Leisure items

Electric bike, golf, photography, skiing or horse-riding… Foyer understands that you are living your passions to the full.

Whatever your hobbies are, with mozaïk, your equipment is insured around the world in case of theft, accidental breakage or impact.

Valuable items and collections

Do you like watches, do you collect vinyl records or do you have a collection of handbags?

Don’t be afraid to take them out any more. With mozaïk, you are insured against theft and breakage at your home and elsewhere.

Private life accidents

Accidents in your private life claim more victims than traffic accidents.

mozaïk offers you financial protection as well as day-to-day assistance

Appraise the contents of your home

To be fully insured, it is important to know the exact value of your furniture and belongings. This leaflet will make it easy to estimate the value of everything you have accumulated over the years

Calculate your home insurance rate

- Do you live in an apartment?

In three clicks, find out the rate for your home insurance and select the options that suit you. - Do you live in a house?

Your insurance needs require the expertise of an agent to offer you the best coverage. We invite you to get in touch with a Foyer agent or leave us your details and we’ll get back to you.

In case of claim

To make life easier, we offer you services adapted to every situation.

24/7 assistance

Because accidents happen when you least expect, we provide you with 24/7 assistance.

Customised advice

As you need to be reassured and advised in difficult times, our network of agents is at your disposal.

Personalised expertise

Because all claims are different, we offer several types of appraisals to assess your damage.

Tailored compensation

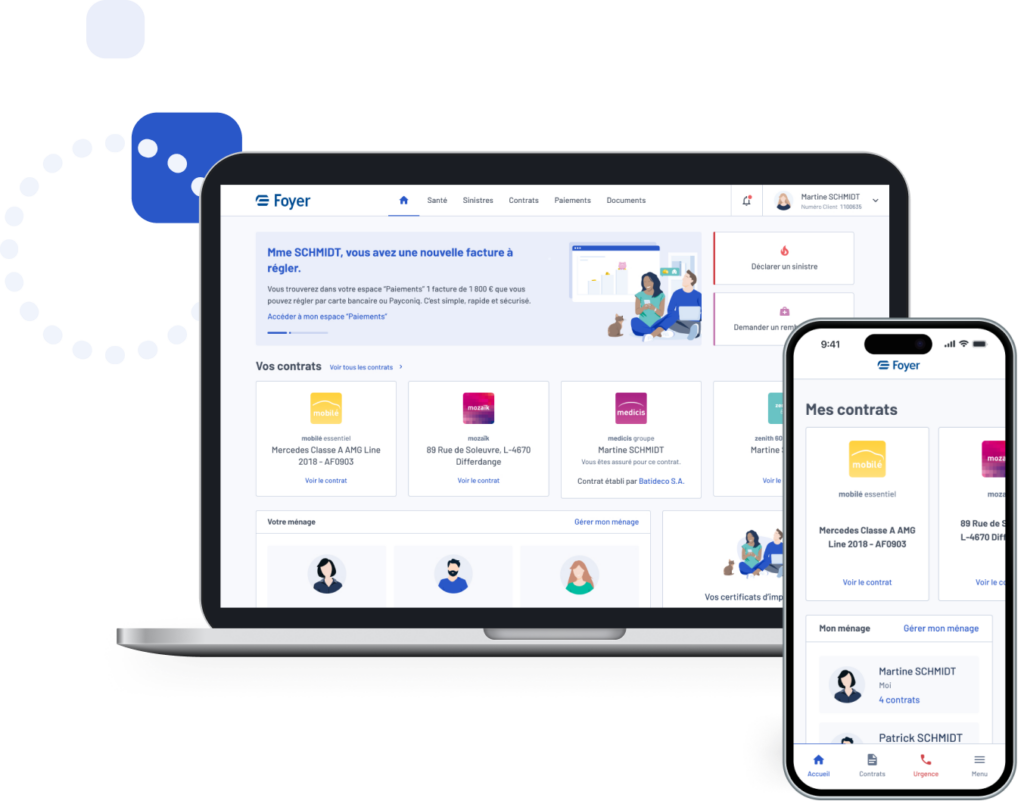

As you don’t always have the time to go to your agent, you can send your declaration in a few clicks using the MyFoyer app. The application is available on your app store.

Customised advice

Because you want to choose your compensation method, we offer you as part of a home incident claim the possibility of choosing the one which best suits your situation.

Although many types of insurance are essential, not all of them are required. This is particularly the case for private liability insurance, home insurance and supplementary health insurance. This article will help clarify the situation and answer your questions about what’s required, what’s necessary and what’s simply useful.

Third party liability is the most important, and sometimes mandatory, element of a motor or a personal insurance policy. It makes sense, as this principle is one of the pillars of society – who breaks pays. Well, not quite, that is what third party liability insurance is all about, it comes into play on your behalf and protects your money.

In 2020, the Grand Duchy had about 265,000 households, including over 170,000 owner-occupiers. Home insurance isn’t a legal requirement in Luxembourg, but is nonetheless highly recommended. Tenants will often find it’s a mandatory requirement in their rental agreement. Yet, many don’t do their homework, which can cost them dearly when they make a claim. So before you take out a policy, learn about the 6 mistakes to avoid and ensure you get the best cover.

Foyer blog

Find all our advice on the blog

You can discover all our articles written by experts to help you understand the world of insurance, give you the best advice and above all, help you prevent risks in your everyday life.

The insurance check-up, the central instrument of our advisory approach

As an insurer, our role is to guide you towards the type of coverage most suited to your daily activities so that you feel fully protected.

To help everyone clarify their situation, we have developed what we call the “customer assessment“. It’s a simple, intuitive tool that provides an overview of your insurance needs, defines your priority requirements and your medium- and long-term prospects, and guides you towards a personalised solution.

To take advantage of this service, just make an appointment with a Foyer agent, it’s free and with no obligation.

MyFoyer Client Area

In your MyFoyer client area, you can view your contracts, request a tax certificate or update your personal details.

Vos garanties indispensables

Fire and associated risks

First and foremost, this cover protects your home in case of fire, explosion or any other damage caused by impact of a vehicle or fallen trees or electric poles, for example. It also covers damage caused to your electrical appliances such as your refrigerator or television due to lightening or power surges.

Terrorist attacks, labour disputes, vandalism and damage to real estate property

The policy covers property damage caused by riots, popular movements and acts of terrorism, sabotage, vandalism and malice, including graffiti.

Storms, hail, weight of snow and ice on roofs

In case of storm, hail or damage caused by the weight of snow or ice, this cover protects your house as well as your garden furniture.

Water damage and frozen installation

mozaïk covers you against leaks, ingress of water through the roof, freezing of heating systems, as well as oil leaks.

Breakage of windows, glass and mirrors

In case of breakages or cracks, mozaïk covers the glass areas of your property and its contents, such as windows, the glass in your furniture or interior and exterior doors, or even your ceramic hob.

Do you still have questions about cover?

Our agents are here to help you